Real Estate Investing Strategies: Your Comprehensive Guide to Building Wealth

Real estate investing stands as one of the most reliable paths to building long-term wealth and achieving financial independence. This comprehensive guide will walk you through the essential strategies, concepts, and considerations you need to succeed in the world of real estate investing.

Why Invest in Real Estate?

Real estate offers several unique advantages as an investment vehicle:

- Potential for steady cash flow through rental income

- Long-term appreciation of property values

- Tax benefits and deductions

- Leverage to build wealth using other people’s money (OPM)

- Hedge against inflation

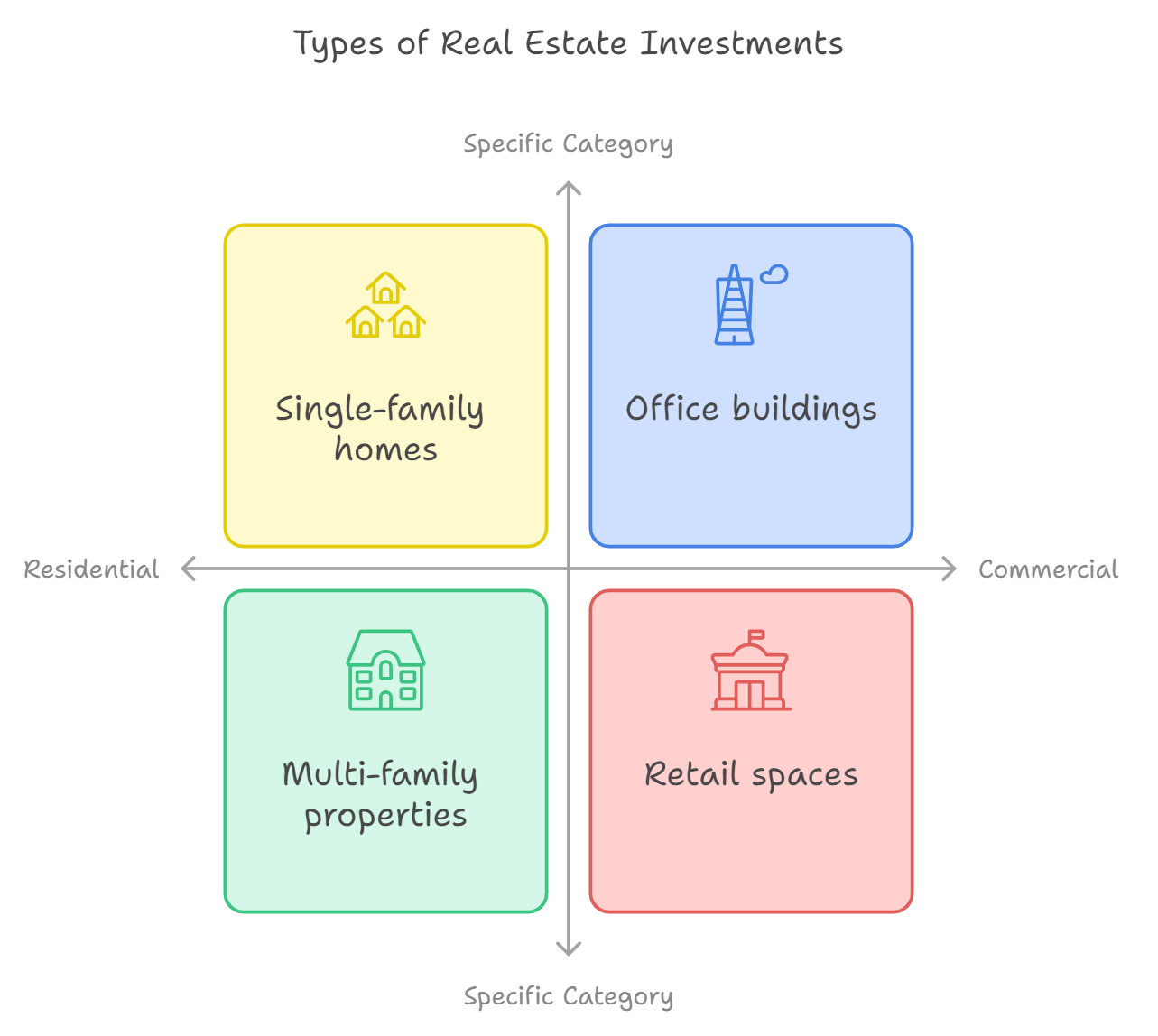

Types of Real Estate Investments

Real estate investments come in various forms, each with its own set of advantages and challenges:

Residential Real Estate

- Single-family homes

- Multi-family properties (duplexes, triplexes, apartment buildings)

- Condominiums and townhouses

Commercial Real Estate

- Office buildings

- Retail spaces

- Industrial properties

- Multi-use buildings

For an in-depth comparison of these options, explore our guide on Residential vs. Commercial Real Estate Investing: Choosing Your Path.

Popular Real Estate Investing Strategies

Buy and Hold Strategy

The buy and hold strategy involves purchasing properties with the intention of holding them for an extended period. This approach can provide both ongoing rental income and long-term appreciation.

Key Considerations for Buy and Hold

- Location selection

- Property management

- Financing options

- Tax implications

Fix and Flip Strategy

Fix and flip involves purchasing undervalued properties, renovating them, and selling them for a profit. This strategy requires a keen eye for potential and strong project management skills.

Steps in a Successful Fix and Flip

- Finding undervalued properties

- Accurately estimating renovation costs

- Managing the renovation process

- Marketing and selling the property

To understand which strategy might be best for your goals and risk tolerance, check out our detailed comparison: Fix and Flip vs. Buy and Hold: Comparing Popular Investment Strategies.

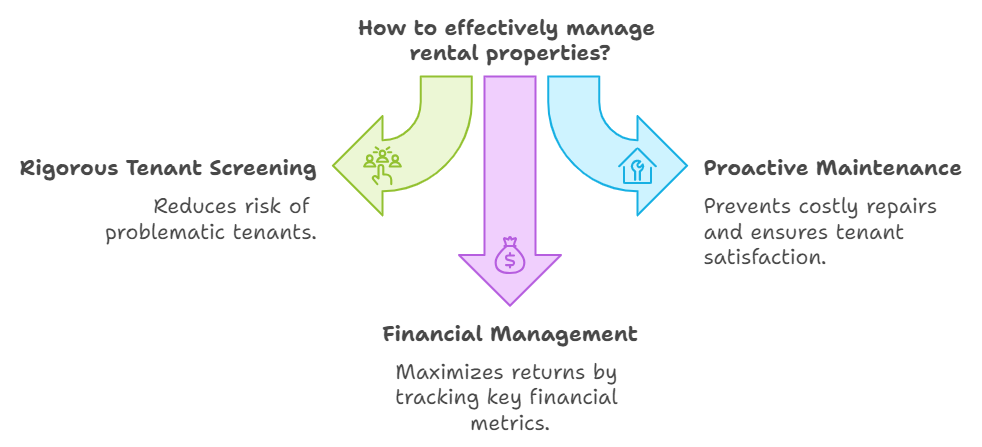

Mastering Rental Property Management

Effective property management is crucial for maximizing returns on your real estate investments.

Tenant Screening and Selection

Key Aspects of Tenant Screening

- Credit checks

- Employment verification

- Rental history

- Criminal background checks

Maintenance and Repairs

Proactive Maintenance Strategies

- Regular property inspections

- Preventive maintenance schedules

- Building a reliable contractor network

Financial Management of Rental Properties

Essential Financial Metrics to Track

- Net Operating Income (NOI)

- Cap Rate

- Cash-on-Cash Return

- Return on Investment (ROI)

Learn more about maximizing your rental property potential in our guide: Rental Property Management: From Tenant Screening to Passive Income.

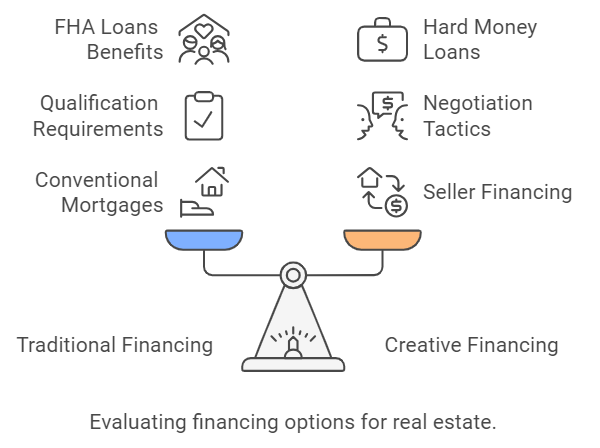

Financing Your Real Estate Ventures

Understanding various financing options is crucial for real estate investors.

Traditional Financing Methods

Conventional Mortgages

- Pros and cons

- Qualification requirements

FHA Loans

- Benefits for owner-occupants

- Limitations for investors

Creative Financing Strategies

Seller Financing

- How it works

- Negotiation tactics

Hard Money Loans

- When to use the

- Calculating costs and risks

Explore alternative financing strategies in our comprehensive article: Creative Financing in Real Estate: Beyond Traditional Mortgages.

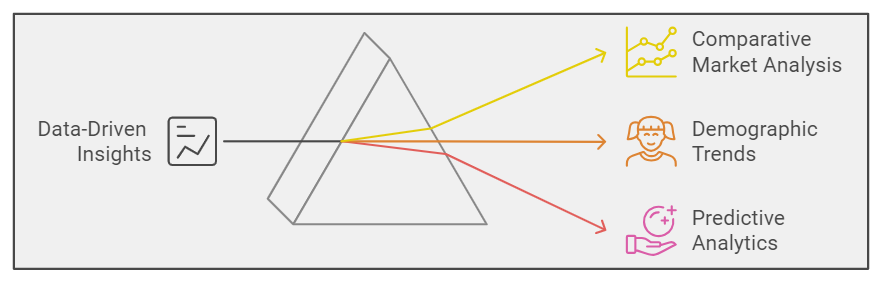

Data-Driven Decision Making in Real Estate

Leveraging data and analytics can give you a significant edge in today’s competitive market.

Market Analysis Techniques

Comparative Market Analysis (CMA)

- Steps to conduct a CMA

- Interpreting CMA results

Demographic Trend Analysis

- Key demographic indicators to watch

- How demographic shifts impact real estate markets

Predictive Analytics in Real Estate

Machine Learning Models

- How AI predicts property values

- Using predictive models in your investment strategy

Dive deeper into market analysis techniques with our expert guide: Real Estate Market Analysis: Data-Driven Decision Making for Investors.

Building and Scaling Your Real Estate Portfolio

As you gain experience and capital, you’ll want to expand your real estate portfolio strategically.

Diversification Strategies

Geographic Diversification

- Pros and cons of investing in multiple markets

- How to research new markets effectively

Property Type Diversification

- Balancing residential and commercial investments

- Exploring niche property types (e.g., student housing, senior living)

Scaling Challenges and Solutions

Property Management at Scale

- When to hire a property management company

- Building systems for efficient portfolio management

Financing Growth

- Leveraging equity in existing properties

- Exploring commercial lending options

Learn how to take your investments to the next level with our insights on [Building and Scaling Your Real Estate Portfolio].

Navigating Tax Strategies and Legal Structures

Optimizing your tax strategy and choosing the right legal structure can significantly impact your bottom line.

Tax Strategies for Real Estate Investors

Depreciation Benefits

- Understanding straight-line vs. accelerated depreciation

- Bonus depreciation opportunities

1031 Exchanges

- Rules and requirements

- Strategic use in portfolio growth

Legal Structures for Real Estate Investing

Limited Liability Companies (LLCs)

- Benefits of using LLCs for real estate

- Single-member vs. multi-member LLCs

Real Estate Investment Trusts (REITs)

- How REITs work

- Pros and cons for investors

Get expert advice on maximizing your returns and protecting your assets in our guide: [Tax Strategies and Legal Structures for Real Estate Investors].

Leveraging Technology in Real Estate Investing

The real estate industry is being transformed by technology.

Property Management Software

Features to Look For

- Rent collection and financial tracking

- Maintenance request management

- Tenant communication tools

Virtual and Augmented Reality in Real Estate

Virtual Property Tours

- Benefits for investors and tenants

- Tools for creating virtual tours

AR for Property Visualization

- Using AR for renovation planning

- AR in commercial property marketing

Discover how to harness the power of technology in your investing journey: [Technology in Real Estate: Leveraging AI, VR, and Analytics Tools].

Managing Risk in Real Estate Investments

While real estate can be lucrative, it’s important to understand and mitigate potential risks.

Insurance Strategies

Property Insurance Essentials

- Coverage types for different property classes

- Determining appropriate coverage levels

Liability Protection

- Umbrella policies for real estate investors

- The role of LLCs in liability protection

Market Risk Mitigation

Diversification Tactics

- Balancing your portfolio across markets and property types

- Using REITs for additional diversification

Exit Strategies

- Planning for market downturns

- When and how to sell properties strategically

Learn more about safeguarding your real estate portfolio in our comprehensive guide: [Risk Management and Insurance in Real Estate Investing].

Achieving Financial Independence Through Real Estate

Real estate investing can be a powerful tool for achieving financial independence.

Building Passive Income Streams

Rental Property Strategies

- Maximizing cash flow from rentals

- Strategies for reducing vacancies

Note Investing

- How to invest in real estate notes

- Pros and cons of note investing

Wealth Accumulation Through Appreciation

Long-term Hold Strategies

- Identifying properties with high appreciation potential

- Balancing cash flow and appreciation

Forced Appreciation Techniques

- Value-add strategies for commercial properties

- Renovation tactics for residential investments

Discover strategies for creating sustainable wealth through real estate in our article: [Real Estate for Financial Independence: Creating Sustainable Wealth].

Conclusion: Your Next Steps in Real Estate Investing

Embarking on your real estate investing journey requires education, strategy, and ongoing learning. At Trust Your Talent Academy, we’re committed to providing you with the knowledge and tools needed to succeed in the dynamic world of real estate investing.

Ready to take your real estate investing skills to the next level? Explore our comprehensive courses tailored to investors at all stages. For personalized guidance, consider scheduling a strategy session with one of our expert mentors. And don’t miss our upcoming events, where you can network with fellow investors and learn from industry leaders.

Remember, successful real estate investing is a journey, not a destination. With the right education, strategies, and mindset, you’re well on your way to building lasting wealth through real estate.

Frequently Asked Questions

The amount needed varies depending on the investment strategy and market. Some options, like house hacking or wholesaling, can be started with minimal capital. Traditional property purchases typically require a down payment of 20-25% of the property value.

Like any investment, real estate comes with risks. However, with proper education, due diligence, and risk management strategies, many of these risks can be mitigated. Diversification and thorough market research are key to reducing risk.

Good deals can be found through various channels, including:

Multiple Listing Service (MLS)

Off-market properties (direct mail, networking)

Foreclosures and auctions

Real estate wholesalers

Developing a strong network and using data-driven analysis can help identify promising opportunities.

Both approaches have merits. Investing locally allows for easier property management and better market knowledge. However, investing in other markets can provide diversification and potentially better returns. The decision should be based on your investment goals, risk tolerance, and market conditions.

Key factors to consider include:

Location and neighborhood trends

Property condition and potential renovation costs

Rental income potential

Appreciation prospects

Local economic indicators

Utilize tools like comparative market analysis and cash flow calculations to assess potential investments.